Half of US metros rising, half are falling. How does Sarasota compare?

If you’ve read the latest housing headlines, you’ve probably seen some conflicting takes.

And when you zoom out, it makes sense as to why: A new Zillow report found that, in half of the country’s largest metros, home values rose over the past year. In the other half, they fell.

So today, we’re breaking down what’s happening nationally, and more importantly, how it compares to what we’re seeing here in the Sarasota/Bradenton market.

National Market Trends

At the national level, home values have barely moved, rising just 0.2% over the past year.

- Home values rose in 25 major markets, mostly in the Midwest and Northeast. Cleveland (+4.7%) and Hartford (+4.5%) led the pack.

- Home values fell in 25 markets, especially in the South and West. Tampa (-6.2%), Austin (-6%), and Miami (-4.6%) saw the steepest declines.

Aside from home prices, here’s what’s happening across the country:

- Sellers cut prices on 27.4% of listings, the highest rate since tracking began in 2018.

- Homes are lingering on the market longer, with a median 60 days on market, the slowest July in over a decade.

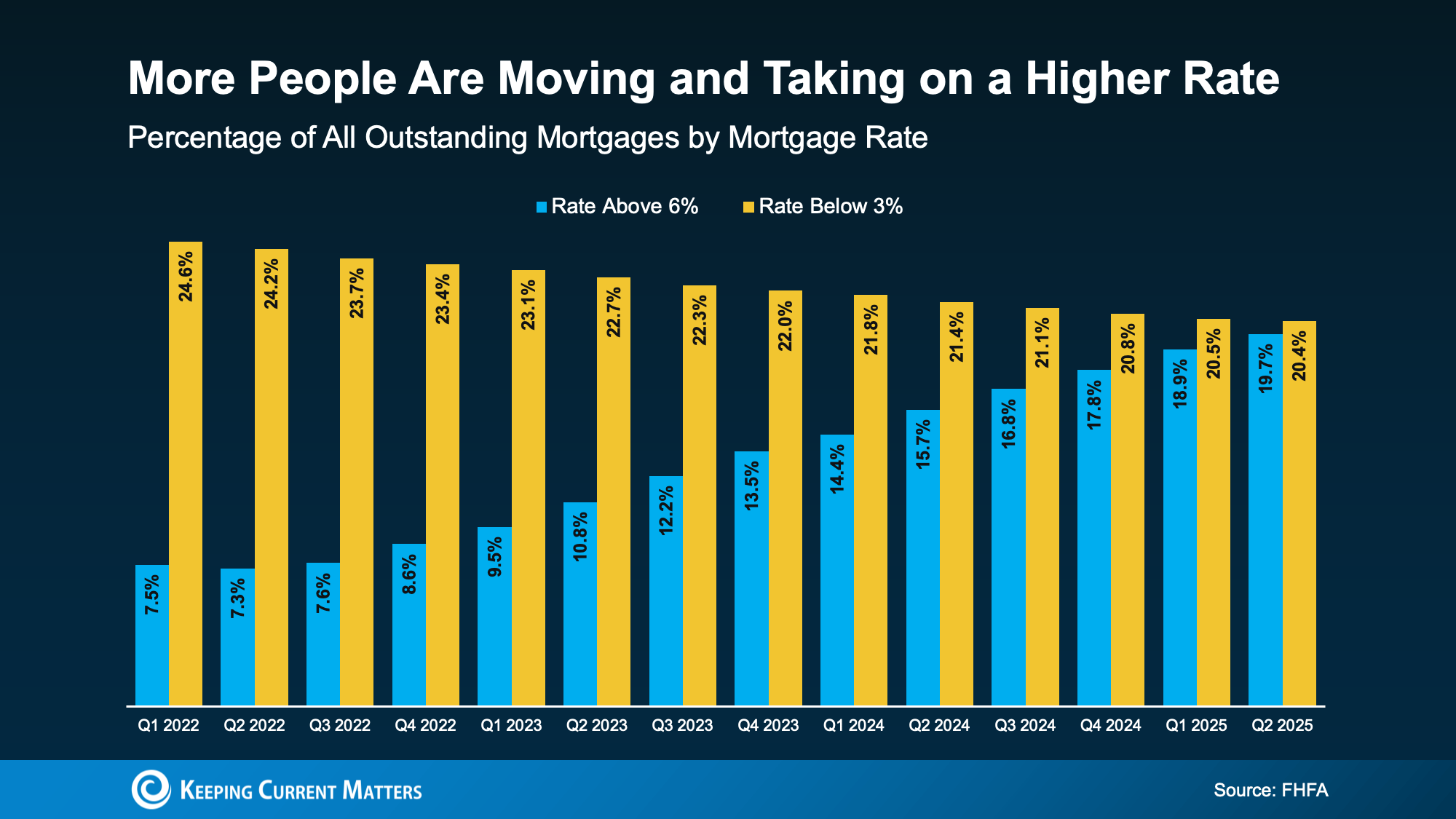

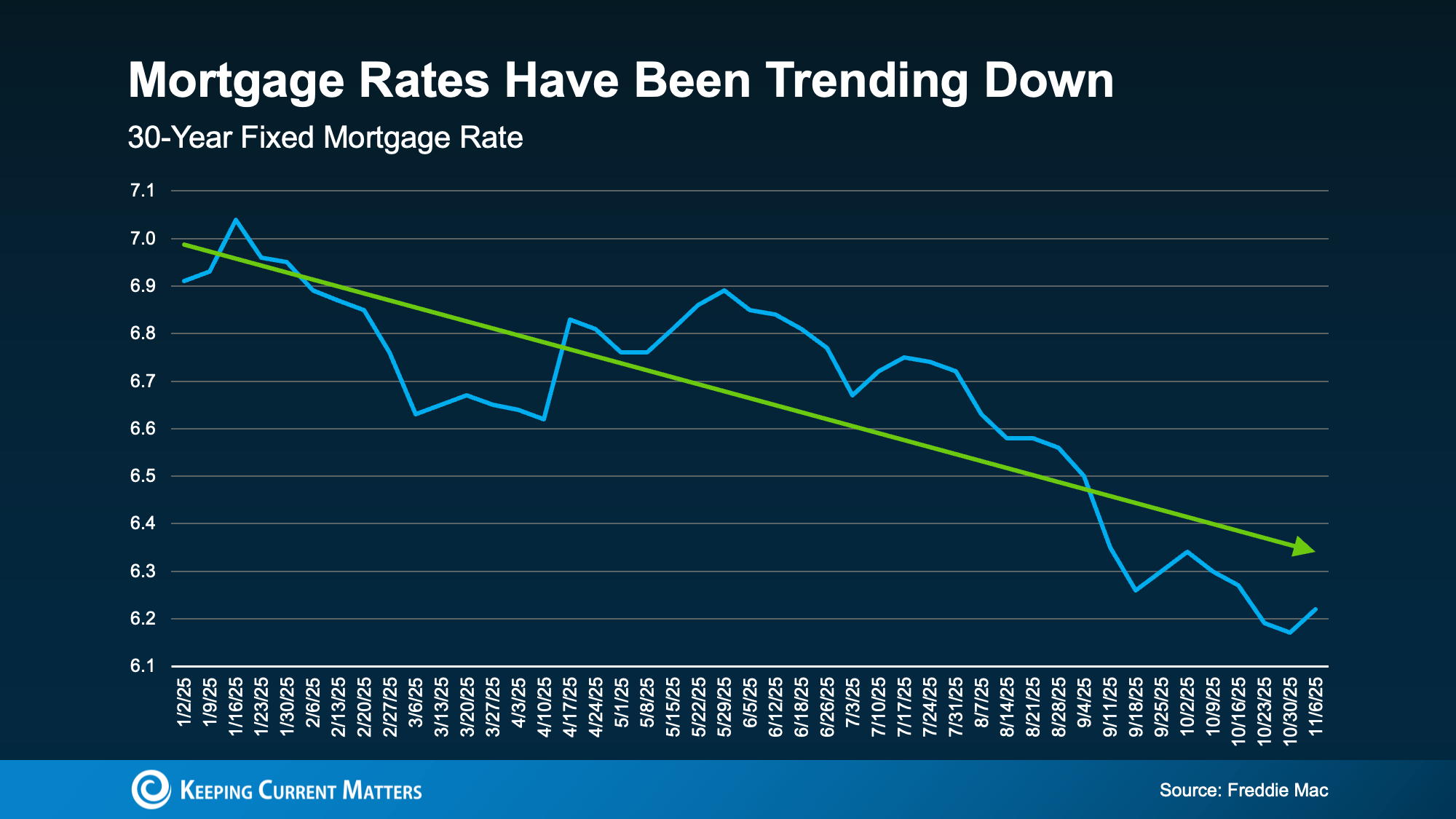

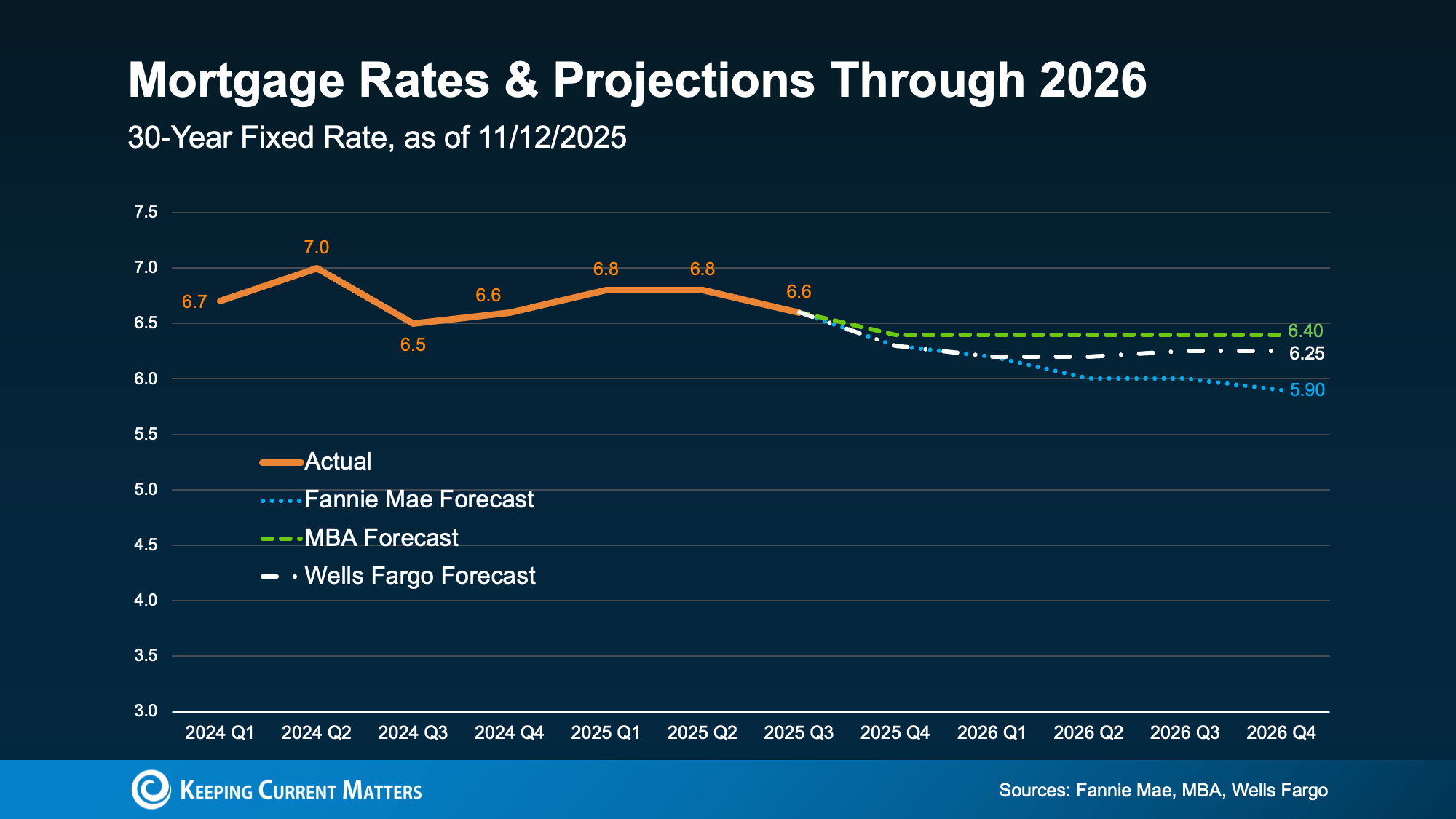

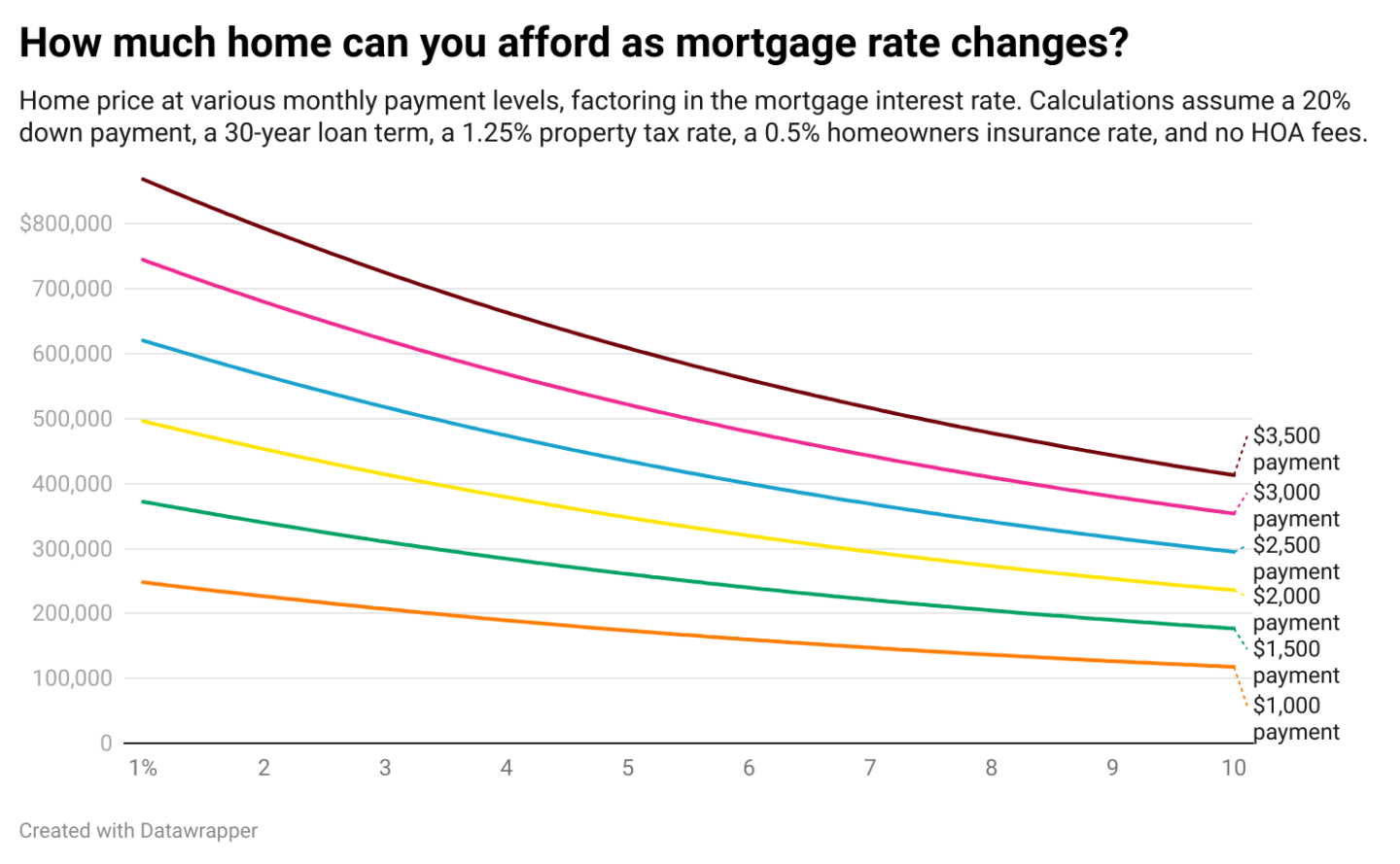

- Mortgage costs are down slightly, about $19 per month compared to last year, but still nearly $1,000 higher than before the pandemic.

That means affordability remains a challenge, even in markets where buyers have the upper hand.

What’s Happening in Sarasota

National trends don’t always tell the full story. Here in the Sarasota area

- Median home price: $480,00 compared to $487,000 a year ago

- Price cuts: Median percent of sales price to original listing price: 92%

- Days on market: Homes here are selling in 60 days on average, compared to the national 60-day median, and taking 103 days to close.

Sarasota/Manatee have 5.2 months of inventory, compared to 4.4 a year ago, so homes are staying on the market longer.

We currently have 6533 homes on the market, compared to 5556 last year, for a 17.6% increase. Sellers have more competition, and buyers have more choices.

What It Means for Buyers

Nationally, buyers are seeing more homes sit longer and more price cuts. In Sarasota, buyers are finding more options and taking longer to decide.

If you’re looking to buy, here’s my advice:

- Watch for price reductions. It’s a sign sellers are willing to negotiate.

- Get pre-approved so you’re ready to act when the right home hits the market.

- Don’t assume headlines about “falling prices” apply here. Check the local stats.

- Don’t take too long to decide. Many well priced homes are getting multiple offers within days of hitting the market, and buyers thinking that no one else is looking are losing out on homes they love.

What It Means for Sellers

The national data is clear: Homes that are overpriced are sitting. Homes that are priced right are still selling.

In the Sarasota/Manatee area, we’re seeing well-priced homes move in under 20 days, and overpriced listings linger past 60 days. Condo sellers are struggling, with local stories about condo fees and the Milestone Inspection requirements confusing buyers and slowing sales.

If you’re thinking of selling, remember:

- Pricing competitively from the start is more important than ever.

- Buyers are savvy, with plenty of data at their fingertips.

- Making your home shine online with great photos, 3D tours, or floor plans can help you stand out.

The Bottom Line

Kara Ng, a senior economist at Zillow, summed it up best: “Perhaps more than ever, whether it’s a good time to buy depends on where you live.”

The housing market is split nationally, but what really matters is what’s happening locally. If you’re thinking of buying or selling in Sarasota, the numbers show that strategy matters more than ever.

Pricing, timing, and presentation will determine who wins in this market.

Categories

Recent Posts

GET MORE INFORMATION